unemployment benefits tax refund

File 2016 Tax Return. But what this exclusion means is if you paid taxes on unemployment insurance.

What You Should Know About Unemployment Tax Refund

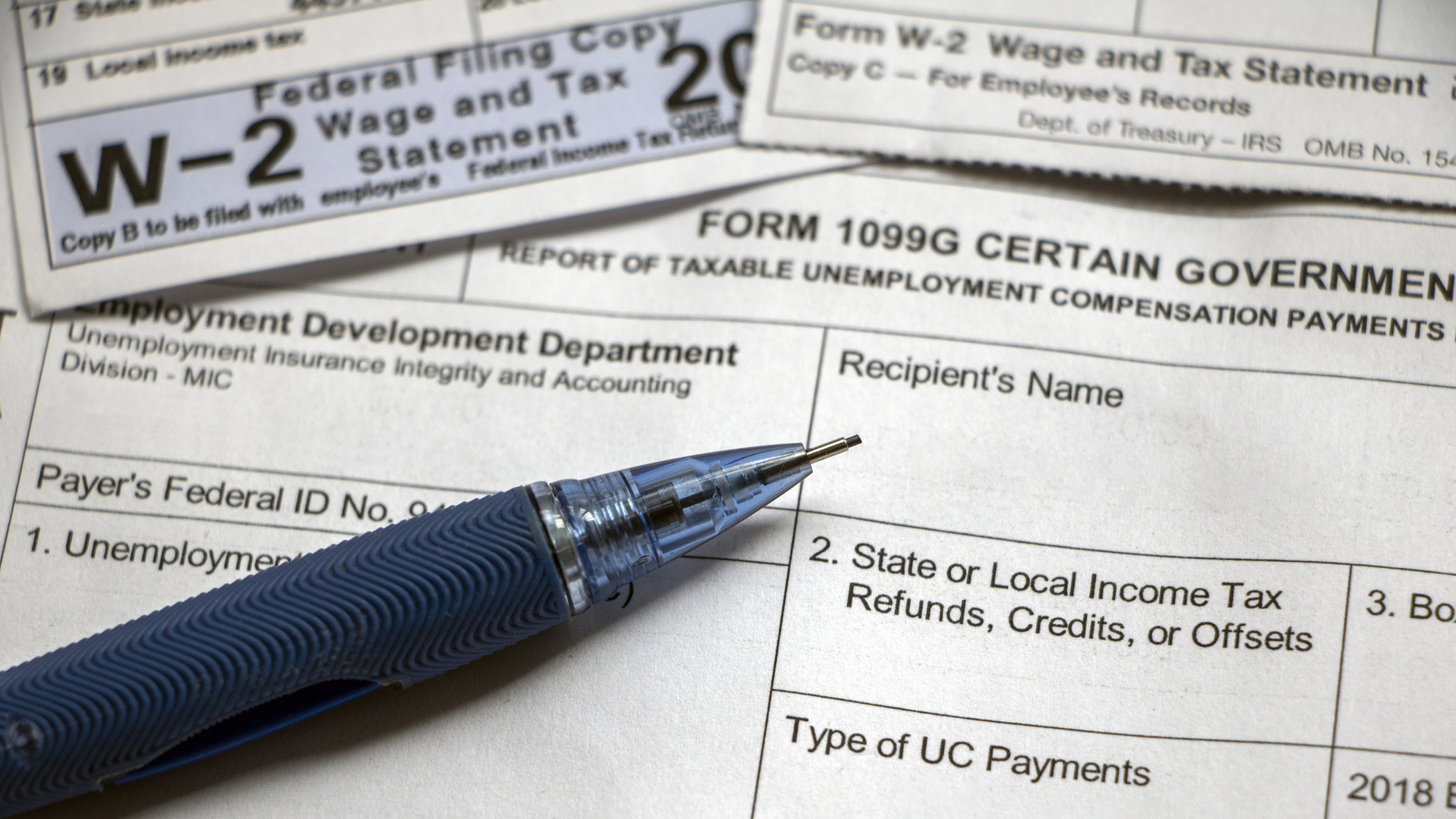

Total the New York State tax withheld amounts from all IT-1099-UI forms.

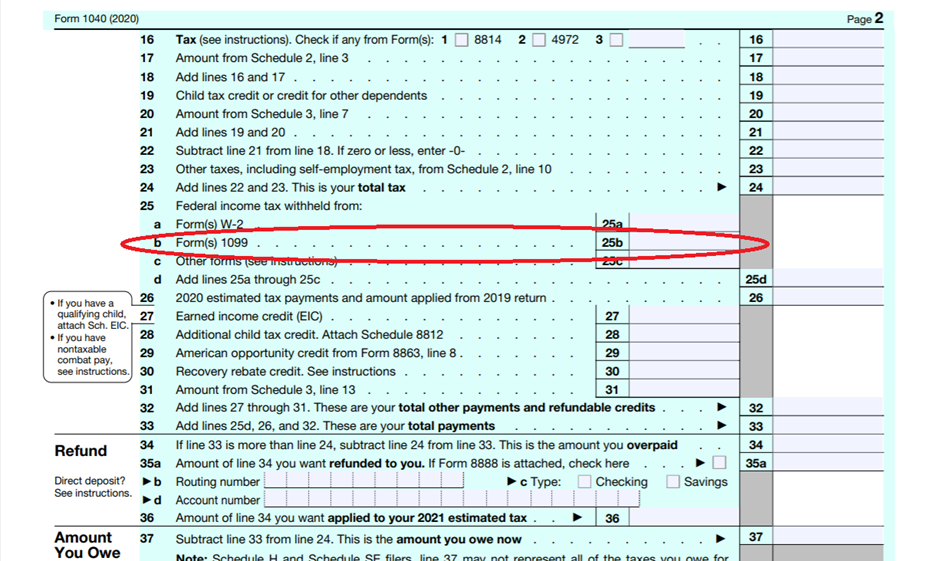

. IR-2021-71 March 31 2021. File 2017 Tax Return. The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly or.

Reporting unemployment benefits on your tax return You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional. Chances are youve already paid your income taxes for 2020. Its best to locate your tax transcript or try to track your refund using the Wheres My Refund tool.

Effects of the Unemployment Insurance Exclusion. The American Rescue Plan pandemic relief bill switched up the law so that people who collected unemployment in 2020 could exclude up to 10200 of unemployment payments. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

File 2021 Tax Return. The Department of Labor works very hard to protect the integrity of our agency and programs. New York State which distributed 127000000 in unemployment insurance tax refunds to employers with stable employment records this year has no tax melon to cut for 1950.

File 2019 Tax Return. IRS to send refunds for taxes paid on unemployment benefits. To combat and stop unemployment insurance UI fraud and identity theft we work actively.

The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. File 2018 Tax Return. If I Paid Taxes On Unemployment Benefits Will I Get A Refund Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than.

If your adjusted gross income AGI is 150000 or less the first 10200 of any unemployment income is not taxable. File 2020 Tax Return. The unemployment tax refund is only for those filing individually.

WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this. Include this total on the Total New York State tax withheld line on your New York State income tax return. Keep in mind you arent going to get 10200 refunded.

The Irs Is Sending Out 4 Million Refunds Related To 2020 Unemployment

Tax Refund Whiplash Pandemic Perks Give Some A Windfall Others A Bill Politico

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Tax Refunds For Unemployed Americans Are Hitting Bank Accounts Cbs News

Irs Issues More Tax Refunds Relating To Jobless Benefits

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

1099 G Unemployment Compensation 1099g

Ask The I Team How Can Mainers Get A Refund For Taxes Paid On Unemployment Benefits Wgme

Asked And Answered Filing Taxes While On Unemployment

Dwd Will Collect Unemployment Overpayments From Tax Refunds

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Irs Sending You More Money Unemployment Refunds Coming Kare11 Com